Which gold or silver bullion to buy?

Bars are the most cost effective and recommended form to accumulate investment grade precious metal. They have the lowest premium and cost when compared to coins or collectables because these bars are in the rawest possible form. Bars, especially the casting type require minimum fabrication to make and this directly translate their costing.

In some market, you may see rounds being offered as well. They are gold or silver bar, minted in round format. Rounds are the second closest to bars in term of costing. However, even though round have the same purity as bullion, they are not recognized as investment precious metal in Malaysia and is therefore, subjected to import tax and GST.

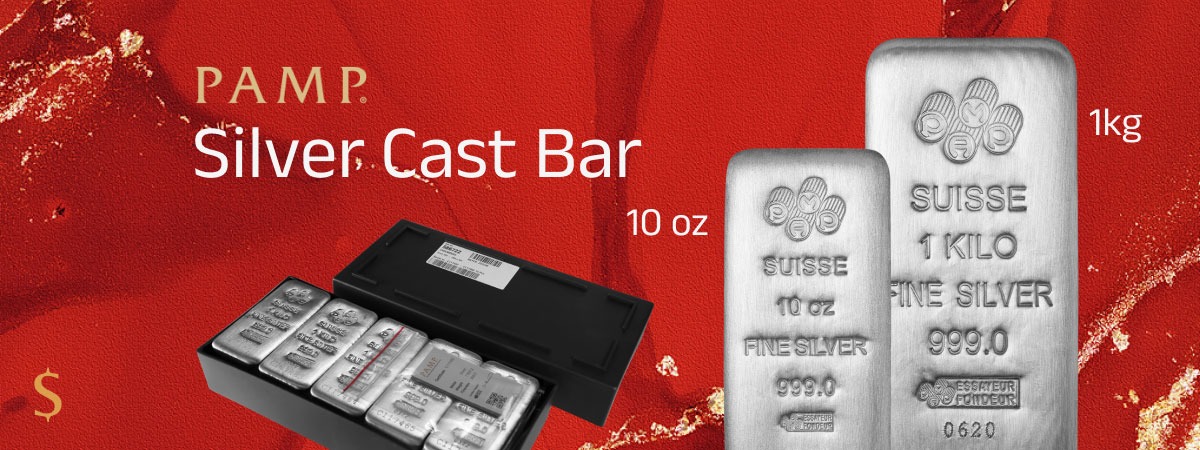

Mints that are involved in producing gold or silver bars are usually from mining, metal recycling or financial industries. Popular hallmark for bars are PAMP Suisse (Switzerland), Asahi Refining (Japan) or Johnson Matthey (British), Republic Metals Corporation (USA) and Engelhard (USA/Australia).

The definition of coins is bullion rounds that bare legal tender from country of origin. Widely popular gold and silver coins are American Eagles, Canadian Maples, Australian Kangaroos and Chinese Pandas to name a few. Malaysia’s own gold bullion coin is the Kijang Emas, distributed only by banks appointed by Bank Negara.

Coins carry higher premium over bars because of the legal tender status. Most coins are beautifully designed, engraved and produced. This is to represent the craftsmanship of the country it represents. These sophistications increase the cost because of the higher expectation and requirement to make.

Mints that make legal tender coins are mostly government owned, or government linked. Royal Canadian Mint is owned by the government of Canada which mint Canadian Maples and Royal Canadian Bars. Perth Mint is owned by the State Government of Western Australian. China’s Mint, the maker of famous Panda coins is owned by the Republic of China government.

Although both gold and silver coins are tax exempted from GST, silver coins are subjected to 5% import tax and this immediately increases the cost for silver bullion coins. Gold coins are not subjected to import tax.

Collectable gold and silver can be in various form, in coins, bars or in odd form such as in shaped of an animal or even a country. All collectables are limited in numbers although the numbers can range from being 1 to 300,000 pieces. The lower the number translate the higher the premium because of scarcity.

Collectables have unlimited upside potential. One example is the 2007 Mongolian Togrog Gulo Gulo Wolverine 1 oz silver coin. Limited with only 2500 pieces, it was sold for USD$100 when it was first released by National Bank of Mongolia. This coin was awarded the coin of the year in 2009 and immediate rocketed the price up the moon. Today, if you are able to find any, it would cost you USD$2,000 a piece.

Perth Mint is famous for their Chinese Lunar gold and silver coin series. Every year, the mint will release one animal design to represent the current horoscope year and this circle takes 12 years to completes, making the collection a 12-year continuous marathon!

Another type of possible collectables is with serial numbers. Serial numbers are commonly engraved onto gold and silver bars. These numbers itself, can potentially be a collection if they are in special arrangement such as, low serial numbers – for serial numbers between 1 to 100, ladder serial numbers – for serial numbers such as 123456 or in reserve 654321, and solid serial numbers – for every numbers bearing the same digit such as 888888 or 999999.

For rare cases, there are some people willing to pay extra for serial numbers that have special meaning to them. For numbers that assemble birthday of theirs or their closed family members, or car registration plates or even some spiritual preference.

We recommend collecting pieces that attracts your personal preference. There is no correct formula on how to buy collectables. No one would know if the collection you buy today may or may not explode with returns. Non performing collections have zero or minimal appreciation, and at worst, it will still worth the price for its metal content.

In general, it is recommended to get bigger size for value. However, here are some factors that you want to consider before choosing your ideal size and weight.

For gold and silver bar, the possibility for sizing is almost infinity. They ranged from 1 gram to 1,000 oz (31.1 kg).

However, if the size is too big, it can be difficult to liquidate, transport or store. While 1 piece of kilo gold bar is cheaper than 10 pieces of 100 grams of individual bars, it is easier to split your 100 gram gold bars when you want to sell your kilo investment partially and separately.

We recommend investment gold bars between 10 grams to 100 grams. Silver bars, it is best to accumulate bars between 10 oz (0.31 kg) to 1 kilo (32.15 oz).

Coins are commonly in troy ounces (31.1 gram). We recommend buying coins in 1 troy ounce denomination because this is the most popular weight.

There are worrying amount of fakes and counterfeits in the market. The most common ones are faking the originality of prized collectables especially coins and limited edition. Chinese Panda for example is one of the most fakes in the market. A genuine panda coin, dated back to 1990s may worth over 10 to 20 times the metal value. This encourages the black market to make them. It is common to find them with 99.9% pure silver content because it is not the silver metal that they are after. It is the collectable value.

For gold, the fakes burry tungsten, a cheaper alternative metal that has almost identical weight to gold. Wrapped up like a bun, the outer layer of the bar is made with 99.9% pure gold with perfectly engraved design similar to what a buyer would expect. However, the content inside the bar is replaced and filled with tungsten. This type of fakes is usually seen in bigger size gold bar.

Therefore, we strongly recommend, press and stress that you buy your gold and silver from reputable companies that have direct distribution from mints to prevent yourself paying for fakes and counterfeits. Be suspicious if sellers are offering selling price that much lower than what a normal operating company would offer.

We advise testing authenticity of your product especially if you are buying large value worth of gold and silver. Test it with various type of test which includes XRF, density and ultra-sound. (For more information on testing, please click here)